Chapter Outline

· New Product Pricing Strategies.

· Product Mix Pricing Strategies.

· Price Adjustment Strategies.

· Price Changes.

· Public policy and Pricing

Companies who develop new products face the challenge of setting price. They choose one strategy out two, which are market skimming strategy and market penetration pricing.

Market-Skimming Pricing:

It is to set higher price for a new product and to skim maximum revenues layer by layer from segments which are willing to pay such higher prices. Company makes fewer but profitable sales.

Condition:

· Product quality and image must support the higher price.

· Sufficient number of people are willing to buy the product at the price.

· Cost of producing small volume shouldn’t be so high, that cancels the advantage of charging high price.

· Competitors should not be able to easily enter the market and undercut the high price.

Example:

Apple, Apple have targeted customers and segments. They make few but profitable sales. Skim the maximum profit.

Market-Penetration Pricing:

It is opposite to skimming strategy. Market-penetration is to set low price for a new product in order to attract large number of buyers and grab large market share. If company succeeds with this strategy and generate high sales, it will result in falling costs allowing the company to cut the prices even further.

Conditions:

· Market must be highly price sensitive.

· Production and distribution cost must decrease with the increase of sales volume.

· Low price must keep the competition out of market, and company should maintain its low-price position. Otherwise, the advantage will be temporary.

Example:

AGIT Global came into market, where surfer use to buy custom-made or high-priced surfboards at local surf shops, at that time surfers had to pay around $300 or $400 for surfboards. AGIT Global started selling surfboard at the price of as low as $99.99. it produces large volume, maintain the quality of boards.

“Product mix is the total number of product lines and individual products or services offered by a company.”

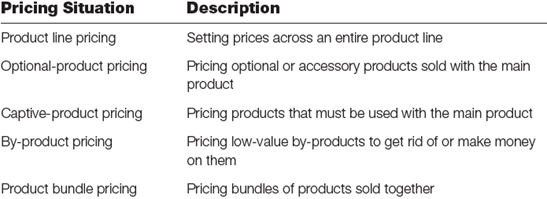

When the product is the part of product mix, then companies often have to change product’ pricing strategy. Firm looks for a set of prices, that maximizes the profit on total product mix. It is difficult, as each product have different demand and costs and face different level of competitions. Mentioned below in the picture are five product mix pricing situations;

Product Line Pricing:

Most of the companies develop product line rather than depending one single product. In this way companies set the price steps between different products in a product line based on cost differences between the products. It should also account for differences in customer perceptions of the value of different features.

Example: Apple introduces product line every year, iPhone X, iPhone X mini, iPhone X pro etc. with different features and different prices.

Optional-Product Pricing:

It is to let the customer opt product pricing by making variations in the product. For Example, a person buys a car and want navigation system in it, or premium entertainment system.

Captive-Product Pricing:

Captive-product pricing is used, when company is producing kind of products, that must be used with main product. These companies set the low prices of main products and charge high markups on supplies.

Example: Printer and cartridges, video games etc.

In services case, companies split the prices into two parts. A fixed fee and variable fee, Example: Sports club charges a fix membership fee on annual or biannual or monthly bases. And charge variable fee from food or by providing other facilities.

By-Product Pricing:

Producing products or services mostly generates by-products. Companies often pay to dispose off this by-product. But some by-products are profitable for companies. Companies earn from these by-products and it eventually helps the company to make the main product’ price more competitive.

Example:

The Layyah Sugar Mill in Pakistan, produce sugar from sugarcane, then its molasses (by-product) is used as fuel to produce electricity.

Product Bundle Pricing:

It is to combine multiple products and offer the bundle at reduced price. It helps the companies to enhance the sale of products consumers might not otherwise buy. Combined price must be low enough to make customers buy the bundle.

Example:

Microsoft office, is sold as bundle to customers. This bundle includes Excel, Word Outlook and PowerPoint etc.

Companies often adjust their basic prices to account for various customer differences and changing situations. These are discount and allowance pricing, segmented pricing, psychological pricing, promotional pricing, geographical pricing, dynamic and online pricing and international pricing. Let’s discuss each.

|

Strategy |

Description |

|

Discount and allowance pricing |

Reducing prices to reward customer responses such as volume purchases, paying early, or promoting the product. |

|

Segmented pricing |

Adjusting prices to allow for differences in customers, products, or locations. |

|

Psychological pricing |

Adjusting prices for psychological effect. |

|

Promotional pricing |

Temporarily reducing prices to spur short-run sales. |

|

Geographical pricing |

Adjusting prices to account for the geographic location of customers. |

|

Dynamic pricing |

Adjusting prices continually to meet the characteristics and needs of individual customers and situations. |

|

International pricing |

Adjusting prices for international markets. |

Discount and Allowance Pricing:

Companies often adjust basic prices to reward customers in return of certain responses. These price adjustments are called as discounts and allowances.

Discount: Discounts can be offered to customers in following forms;

· Cash discounts: It is given to buyers who clear their dues earlier in time. Example, “2/10, net 30”, means bill is due to pay in 30 days but if customer pay the bill in 10 days, he can avail the discount of 2 percent.

· Quantity discounts: A discount on purchasing large volume.

· Functional discounts or functional discount: it is discount offered to trade-channel partners who perform certain functions, example: storing, record keeping, selling etc.

· Seasonal discount: discount offered on out of season stock or buy a merchandise.

Allowance: It is promotional money paid by manufacturers to retailers in return for an agreement to feature the manufacturer’ products in any way.

· Trade-in allowance: a situation in which a business disposed of old assets by exchanging it with a new asset and in return gets allowance in price of new asset.

· Promotional Allowance: these are for retailer to participate in advertisements and sales support programs.

Segmented Pricing:

Company sells a product on two or more than two prices, and this difference in prices in not based on differences in costs. This segmentation pricing takes following forms;

· Customer-segment pricing: Different customers pay different prices for the same product or service, Example, museums, movie theatres and retail stores charge different prices to senior citizens and students.

· Product form pricing: different versions of products are charged differently to customers. And this difference in price is not according to difference in cost. Example, Air ticket to Canada in economy class is of $1100 and for business class its fare is $3300. No doubt business class seats are comfortable, food and other services are premium, but cost difference to airline for both economy and business class is not so much that is charged to customer. So, customers who afford luxury, pay for it.

· Location-based pricing: company charge differently for same product or service in different locations. For example, a restaurant varies its rate list according to different cities. Movie theatres provide different seating area to customers in different locations and so charge differently.

· Time-based pricing: company offer its products at different prices during different seasons, different time, different hour etc. Example, Movie theatre offers lower prices in mid weak and higher prices on weekends. Airlines charge higher on Christmas Eve.

Conditions:

This segmented pricing is effective in following conditions;

· Market should be segmentable.

· Segments must show different degrees of demand.

· The cost difference to company must not exceed with exceed in price, this difference should be little. otherwise, the purpose of charging extra will be killed.

· This segmented pricing should be legal

· Customer paying extra must feel that they are treated with superior services or given the premium product.

· Customers who are paying less, must not feel that they are ignored. Otherwise, it will badly affect the image of company in the long-run.

Psychological Pricing:

Price speaks something important to customers about the product. Consumers use price to judge the quality of product or service. Example, a $90 scent bottle may contain scent of worth $4, but customers pay $90, as price indicates something special.

Psychological Pricing: Companies focus on psychology of prices, not only on economics. When customers are not fully equipped with knowledge, or they don’t have time to sort information about the product, or they don’t have any past experience with the product or service. Then customers use price to judge the quality of product or service.

Example: people trust more on the lawyer who charges $500 per hour than on the one who charges $100 per hour.

Reference Price: another aspect of psychological pricing is reference price. This is the price that the customer carry in his mind, it may be created by noting the current prices, remembering past prices or assessing the buying situations.

Example: Williams-Sonoma introduced a fancy bread maker at the lowest price of $279, then company introduces a model with higher price $429. Resulting expensive model was badly flopped and doubled the sales of cheaper model.

Small differences in prices matter a lot, Example, company uses the digit 9 ($89 than 90, $99 than 100, $99.99 than 100). As this attracts the customers. One psychologist said that each digit has unique symbolic and visual qualities. Digit eight (8) is round and even, it creates a soothing effect. Whereas digit seven (7) is angular and creates jarring effect.

Promotional Pricing:

Companies temporarily decreases the products prices below the list price and sometimes even below cost. Companies adopt this strategy to create buying excitement and urgency among customers. Promotional pricing can take following forms;

· Discounts: Reduced prices from normal prices

· Special Event Pricing: It is offered in specific seasons to attract more customers. Most of the brands offer sales in November and December.

· Limited-time offers: These are kind of flash sales; it creates buying urgency and consumers feel lucky to avail the offer.

· Cash rebates: Rebates can be offered by both manufacturers and retailers. It is to ask shoppers to complete additional steps to get cash backs, Example; a manufacturer will give 5% rebate to distributer or retailer on purchasing of 1000 units of a product costing $200.

· Low-Interest financing: It is to offer loans to customers on much lower interest rates.

· Longer warranties: consumers are given longer warranties to build the trust level.

· Free maintenance: free maintenance is provided to customers to minimize the effect of price in customer mind.

Negative effect:

· Constantly reduced prices can erode a brand’ value in the eyes of customers.

· Customers start waiting for sale before buying products.

· More coupons issued by manufacturers greatly affect the retailer’ profit margins.

Geographical Pricing:

Companies decide whether to charge same price to people living in host country and in far distant country, or to charge higher prices to customers in far distant countries to cover the shipping cost and risk losing the business. Following are five different geographical pricing strategies for different situations;

FOB-origin pricing: FOB stands for “free on board”, it means customer will pay the same price of product placed at FOB point, and will pay whatever the shipping cost may be. Example: 3 different customers buy an LCD from FOB point in China at price of $250, customer-A from Pakistan will pay shipping cost say $3, Customer-B will pay $5 to India and Customer-C will pay $7 to Sri Lanka.

Uniform-delivered Pricing: it is totally different form FOB-origin pricing strategy, company charges same price plus freight to all customers regardless of their location. Example: Customers form Pakistan, UAE or US will pay same price to buy an LCD from Japan.

Zone Pricing: it falls between uniform-delivered pricing and FOB-origin pricing, company sets two or more zones. Customers within a zone will pay same price for the product, more distant the zone, higher the price customer will pay.

Basing-point Pricing: company selects a city, called as “basing point”, and charges all customers the freight from that basing point, regardless of from where actually products are shipped.

If all sellers use the same “basing point”, each company will charge the same price to customers and price competition will be eliminated.

Freight-absorption Pricing: it is when company decide to bear all or partial freight charges. This freight-absorption pricing strategy is used when company is doing with certain customer or in certain geographical area. Companies also do it while penetrating the market or to have some hold on competitive markets.

Dynamic and Online Pricing:

In earlier times, prices were set by the negotiation between sellers and buyers. From the end of nineteenth century, companies started to adopt “a fixed price policy” that is, one price for all buyers. But now companies are modifying the fixed price trend, i-e, the Dynamic Pricing, it is to continually adjust the prices to meet characteristics and needs of individual customers and situations.

Services like airline and hotels change prices according to demand, costs or carefully observing, how much the competitors are charging for the same service. If dynamic prices work well, it can help sellers to maximize sales and serve customers better. And if dynamic pricing is managed poorly, it can erode margins, can start price wars and can damage customer relationship and trust.

Many shopping stores, or online e-commerce websites often offer one day or one hour or peak hour discounted price. Discounts can be offered to regular customers to encourage more spendings. For Example, Uber, a riding service offer discounts to regular users or in different hours in a day to encourage more use of application.

This concept of dynamic pricing should not be used to take advantage of customers, it will erode the relationship with customer and will dent the image of company, Example; Customer reacted very badly to Coca-Cola proposed a vending machine that would adjust prices depending on outside temperatures.

Advancement of technology and online access to almost every customer have benefitted customers a lot, now customers can compare prices of alike product of different brands.

Retailers suggest to devise a strategy to deal with consumer practice of showrooming, it is when consumer compare prices online while in the store. Then request the price matches, and in the end simply buying product online.

International Pricing:

Companies offering products in international markets need to decide what prices to charge in different countries. Companies can adopt uniform worldwide pricing strategy. Example: Boeing sells its Jetliners to every customer at same price in the world. While other companies set different prices to reflect local market conditions and costs incurred.

Companies set prices for different countries depends upon different factors, which are;

· Competitive situations.

· Economic conditions.

· Laws and regulations.

· And nature of wholesaling and retailing system.

· Varying consumer perceptions and preferences.

· Companies alter marketing strategies according to the people of different countries. Example; apple produces premium phones for developed countries and discounted old model for developing or underdeveloped countries.

In most of the cases, price escalation may be the result of difference in selling strategies or market conditions. This price escalation may be due to higher selling costs , which are additional operational costs, product modifications, shipping and insurance, exchange-rate fluctuations and physical distribution, Import tariffs and taxes

Successful companies like Unilever produce products for people from developing countries living at bottom of the pyramid. For example, Unilever makes single-use packages of shampoos, face-creams, laundry detergents, which a poor person can easily purchase. With this strategy Unilever collects 59 percent of total revenue from these emerging economies.

There are certain situations in the market, when a company have to initiate product prices or sometimes have to respond price change by competitors.

Initiating Price changes:

Sometime companies initiate price cuts and sometimes companies increase prices. In both cases, companies must consider reactions of buyer and competitors. Let’s look at each aspect briefly.

Initiating Price Cuts:

Price cut step can be taken by companies in following situations to boost sales and grab maximum market share;

· Company have excess capacity.

· Falling demand due to price competition in the market.

· Or weakened market.

· Price cuts can be made when company have edge of making products at low cost.

· Or cutting price with the hope of gaining more market share that will further cut costs through larger volume.

Example: Lenovo uses this low-cost, low pricing technique and has grabbed maximum market

share of PCs and laptops in the developing markets.

Example 2: Xiaomi has become market leader in as low-price phone maker. It has captured maximum market share in China and penetrating in Pakistan, India and other emerging economies.

Initiating Price Increase:

Successful price increase can greatly improve company’ profit. Price increase often depends on two factors, which are:

Cost-Inflation: When cost increases, it reduces profit margins.

Over-demand: when company cannot fulfil the demand or cannot supply what customers need.

Company must avoid being perceived by customers as price gouger (the act of over pricing). In the result of price gouging customers can permanently shift to competitor’s products.

Techniques to avoid Misperceptions:

First companies should maintain the sense of fairness regarding any price increase. Second, company should effectively communicate the logical reason of price increase.

Avoiding Price Increase:

Companies should always look for ways how to meet higher costs and fulfil demands of customers without increasing prices.

· It can be done through cost-effective ways to produce or distribution.

· It can unbundle market offerings, to remove services, extra features or services, which once were part of the product.

· Companies can shrink the product. Example, Tide maintained the price by shrinking 100-ounce containers to 92-ounce and 50-ounce container to 46 ounces

Buyer Reactions to Price Changes:

Buyer reaction to Prices Increase:

Price increase can initiate two possible perceptions in consumers’ minds, which are;

· Consumer may think that the product has become more exclusive and of better quality.

· 2nd perception, consumers may think that, company have become greedier, and so charging more for same older product and same features.

Buyer reaction to Price Cut:

Price cuts can also initiate two possible perceptions (positive or negative) in consumers’ minds, which are;

· Consumers might think that, they are getting same good quality in reduced price.

· 2nd, consumers may also think that company have compromised the quality of product, so its offering product in reduced price. This can ruin the image of company.

Competitor Reactions to Price Changes:

Companies must consider competitor’ possible reactions; competitors might think;

· Company is trying to grab more market share.

· Company is performing poor, so trying to make a comeback.

· Company wants the whole industry to cut prices to increase demand.

· In case of price increase, company is offering product of better quality.

If all competitors behave alike, that means, a typical analysis is sufficient. If every competitor is behaving differently, then separate analysis is required for each competitor. And if some companies match the price change, then it indicates that the rest of competitors will also match it sooner or later.

Responding to Price Changes:

It is to say, how a firm will respond to competitor’ price change strategy. Firms should seek answers of following question;

· Why competitor changed the price?

· Is this price change is temporary or permanent?

· If our firm didn’t respond to this price change, what will happen to its market share and profits.

· Do other competitors are going to respond this price change?

· Firm should also consider its own situation and strategy and customer’ possible reaction to price change.

A firm can take following four actions against the price change;

Reduce Price: when market is price sensitive, firm can also reduce the price of its product in response to competitor’ price reduction.

Raise Perceived Value: Firm can try to raise the perceived value in minds of customers of its product.

Improve Quality & Increase Price: firm may not change the price and offer better quality in same price.

Launch Low-Priced Fighter Brand: launch a low-priced fighter brand to target price sensitive market along with the premium brand. Example – Starbucks acquired “Seattle’s Best Coffee” a low-priced brand for working class.

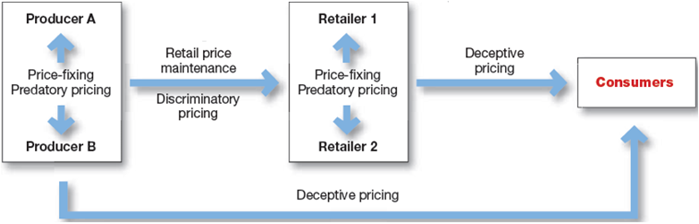

Price competition is core element in free-market economy. But in most of cases, companies are not free to charge whatever they want. Many government laws play their role in fair pricing.

Two Pricing Concepts taken form article; Pharmaceutical Prices in Europe:

· EPR (External Price Referencing):

It is comparing prices in several countries in order to set a benchmark or reference price for the purpose of setting or negotiating the price of product in given country.

· DP (Differential Pricing):

It is to set different prices for different customers, even if the cost is same. It is mostly done, in case, charging higher prices in developed countries and charging lower prices in poor countries for the same product.

Pricing within Channel Levels:

In US, federal legislation takes strict action price fixing. If any firm found guilty over price fixing, authorities impose heavy fine on such companies. Federal legislation says, company should fix product price without consulting with competitors.

For Example: Four US airlines United, Delta, Southwest and American had faced heavy fines, as they artificially inflate airfares to earn huge profits.

Predatory Pricing: it is to sell the product on below cost, with bad intentions of punishing a competitor, or gaining long-run profits by pushing competitors out of business. This law protects smaller businesses from larger ones.

Example: Many booksellers and publisher have raised their concerns about Amazon.com’s Predatory Pricing practices, especially its books pricing.

Note: One important point is, if company is selling its products on below costs to unload excess inventory is not considered as predatory pricing. So, intentions matter a lot, and to determine intentions is very difficult.

Pricing Across Channel Levels:

Price-Discrimination:

Robinson-Patman Act is devised to prevent unfair price discrimination. It means, manufacturer will sell its product at same price to all retailers or dealers. Price discrimination is allowed in following conditions;

· If cost is different in selling a same product to different sellers (depending upon the volume).

· If quality of product demanded varies from retailer to retailer.

· Price discrimination may also be used to match competition. This difference should be temporary, defensive and localized.

Retail Price Maintenance:

This law protects retailers or resellers, i.e., a manufacturer can only suggest the retail price to and can’t restrict retailers to charge a specific retail price. A manufacturer cannot stop selling its products to retailer or dealer who use independent pricing actions.

Deceptive Pricing:

Deceptive pricing is when a seller states prices or price savings that may mislead customers and consumers which are not available in the market to consumers in actual.

· It also involves bogus pricing that include, artificially high “regular prices” increase and then announce sale.

· Using fake price tags.

Price comparisons are legal if it is done in good faith, Federal Trade Commission’s “Guides against deceptive pricing” prevents sellers not to advertise;

· A price reduction until it confirms savings from previous regular price.

· Factory or wholesale price unless prices are what are claimed to be.

· Comparable value prices or imperfect goods.

Scanner Fraud:

Scanning devices are in widespread use these days, it has raised concerns regarding overcharging. it often occurs due to

· Poor management i.e., timely entering current or sale price into system.

· Intentional overcharging.